Insurance

GAP Coverage

Protect Your Truck and Your Wallet

Did you know that if your vehicle is stolen or declared a total loss, you may still be responsible for paying off a portion of the vehicle finance contract?

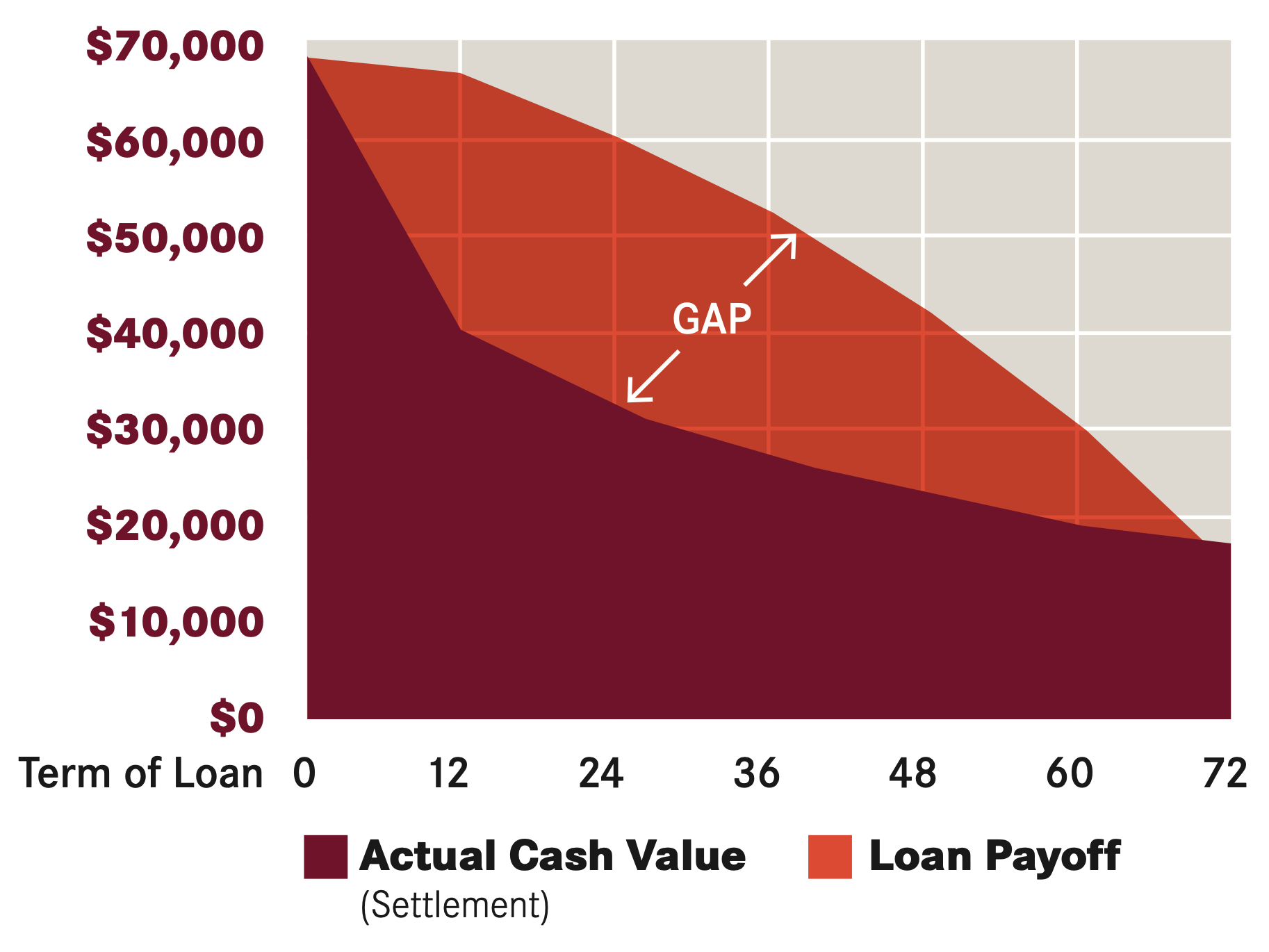

Many people owe more on their finance contract than their insurance company will pay in the event of total loss. GAP is an amendment to a vehicle finance contract that waives a portion or all of what you owe on the finance contract after an insurance settlement is paid for the total loss of a vehicle. GAP will also pay for your insurance deductible (where permitted by state).

Always be Prepared

You may think it won’t happen to you, but the theft or total loss of a vehicle can take you by surprise. The surprise can be twice as unpleasant if your primary insurance carrier’s settlement is less than the amount needed to pay off your finance contract’s outstanding balance.

Confidence in Your Coverage

Premier Financing offers customers exceptional truck protection programs, in addition to convenient financing options insurance offerings provide prompt certificate issuance and quick turnaround times on claims. This, coupled with competitive pricing, makes Premier Financing an appealing choice for your commercial vehicle insurance needs.

Frequently Asked

Questions

Do I need GAP insurance coverage?

GAP is extremely important in maintaining the operations of your business in the event of a total loss. Even putting money down, insurance may not pay you what you think you deserve for your vehicle. And if you owe more on your loan than you receive, GAP coverage will cover the difference, leaving cash in your bank account to operate your business